Selling The Family Business

Protecting your legacy and securing your retirement should be your top priority if you own a family business.

First, Is Your Family Business Fair to All Non-Family Employees?

I am putting this quick tool at the top to make sure your company is ready to sell or transition and you business isn't suffering from "Outsider Syndrome".

A successful family business creates a workplace culture that welcomes non-family employees, treats them with respect, and provides equal advancement opportunities.

Transition Or Sell to Family Member(s)

Pros & Cons

Statistics show that 50 percent of typical business owners want to transfer their business to their children. In actuality, this happens with less than one-third of businesses.

Because this option has a low success rate, a business owner considering this must also develop a contingency plan that involves transitioning the business to another type of buyer.

Advantages:

Personal goal……keeping the business and family together (family legacy).

Could provide financial well-being and a career to younger family members unable to earn a comparable income from outside employment.

Could allow the original business owner to stay actively involved in the business with their children.

Could provide to the owner the luxury of determining how much he wants for the business.

Disadvantages:

May create or increase family discord and feelings of unequal treatment among siblings.

Family members cannot usually afford to pay cash at the business closing. As a result, the selling family member has to accept payment for the business over time.

Financial security and business performance is often diminished over time (especially if the buying family member cannot run it properly).

Family dynamics and issues may diminish the new owner’s control over the business and it’s operations significantly.

FINANCIAL VEHICLES TO UTILIZE TO SELL:

Here are the 6 most common succession strategies:

Deferred Compensation Plans: Deferred compensation plans allow the owner to defer a portion of their salary or bonuses to a later date, typically after retirement. This can help the owner maintain a steady income stream while transferring ownership of the business to successors.

Employee Stock Ownership Plans (ESOPs): ESOPs are retirement plans that allow employees to become partial owners of the company through the allocation of company stock. As the owner transitions ownership to employees, they can continue to draw a salary or receive compensation as an employee or consultant while also benefiting from the value appreciation of the company's stock.

Seller Financing: In a succession plan, the owner can finance the sale of the business to successors by providing a loan or installment payments. This allows the owner to receive regular payments over time while transferring ownership gradually.

Family Limited Partnerships (FLPs): FLPs are legal structures that allow the owner to transfer ownership of assets, including the business, to family members while maintaining control as the general partner. The owner can receive income from the partnership, such as rental income or dividends, while transferring ownership to family members.

Trusts: Trusts can be used to transfer ownership of assets, including the business, to beneficiaries while providing the owner with income through distributions from the trust. Trusts can offer flexibility in structuring distributions and tax benefits.

Consulting Agreements: As part of the succession plan, the owner can enter into consulting agreements with the new owners or management team, providing advisory services in exchange for compensation. This allows the owner to continue contributing expertise to the business while transitioning ownership.

Each of these financial vehicles has its advantages and considerations, and the optimal choice depends on factors such as the owner's goals, the nature of the business, tax implications, and the preferences of successors.

Succession coaching will help in the careful evaluation of these options and structuring the succession plan to achieve the owner's objectives while ensuring financial security and continuity for the business.

A DEEPER DIVE ON FINANCING OPTIONS PROS AND CONS:

Deferred Compensation Plan

Pros:

Allows the owner to defer a portion of their income to a later date, providing financial security in retirement.

Can be structured to provide flexibility in timing and distribution of payments.

May offer tax advantages, as contributions are often tax-deferred until withdrawal.

Cons:

Subject to regulatory limitations and requirements, such as contribution limits and vesting schedules.

Future payouts may be affected by changes in the business's performance or financial condition.

Requires careful planning and administration to comply with legal and tax regulations.

Employee Stock Ownership Plans (ESOPs):

Pros:

Provides a mechanism for employees to become partial owners of the business, fostering a sense of ownership and loyalty.

Can be used as a tax-advantaged exit strategy for the owner, as contributions to ESOPs are often tax-deductible and used to finance the initial loan.

Allows the owner to maintain a role in the business while gradually transitioning ownership to employees.

Cons:

Requires significant administrative and compliance costs to establish and maintain.

Can dilute ownership and control, potentially leading to conflicts or disagreements among shareholders.

Valuation and pricing of company stock can be complex and subjective, leading to disputes or challenges.

Seller Financing:

Pros:

Facilitates the sale of the business to successors who may not have access to external financing.

Allows the owner to receive regular payments over time, providing a steady income stream in retirement.

Provides flexibility in structuring payment terms and conditions based on the buyer's financial capacity.

Cons:

Carries the risk of default or non-payment by the buyer, potentially resulting in financial loss for the owner.

Limits the owner's liquidity and ability to access funds for other purposes.

Requires thorough due diligence and documentation to protect the owner's interests and ensure repayment.

Family Limited Partnerships (FLPs):

Pros:

Allows the owner to transfer ownership of assets, including the business, to family members while retaining control as the general partner.

Provides asset protection and estate planning benefits, as assets held in the partnership may be shielded from creditors and estate taxes.

Offers flexibility in structuring distributions and transferring wealth to future generations.

Cons:

Requires careful planning and legal documentation to comply with partnership laws and regulations.

May lead to conflicts or disagreements among family members regarding management and control of the partnership.

Requires ongoing administration and compliance to maintain the partnership's integrity and tax benefits.

Trusts:

Pros:

Provides a mechanism for transferring ownership of assets, including the business, to beneficiaries while retaining control as the trustee.

Offers flexibility in structuring distributions and managing assets for the benefit of beneficiaries.

Provides asset protection and estate planning benefits, as assets held in trust may be shielded from creditors and estate taxes.

Cons:

Requires careful planning and legal documentation to establish and administer the trust in accordance with trust laws and regulations.

May involve administrative costs and trustee fees, reducing the overall return on investment.

Can be subject to taxation on income and capital gains, depending on the type of trust and distribution structure.

Consulting Agreements:

Pros:

Allows the owner to continue contributing expertise to the business while transitioning ownership to successors.

Provides a source of income for the owner in retirement or as part of the succession plan.

Facilitates knowledge transfer and continuity of operations by leveraging the owner's experience and insights.

Cons:

Requires negotiation and agreement on terms and compensation, which may be subject to conflicts or disagreements.

Can create dependency on the owner's continued involvement, limiting the autonomy and decision-making authority of successors.

May face challenges in balancing the owner's role as a consultant with the authority and responsibilities of new management.

WHICH OPTION IS BEST FOR YOU?

... IT DEPENDS!

I hate that answer, but there are so many variables at play, there isn't a single right answer. Let's have a chat and I will help you navigate these options and when the time is right for you, introduce you to the right people you need to talk to.

OK, After I Pick The Financial Vehicle, Then What Do I Do?

By following these recommendations, you, the business owner can navigate the process of selling their business to a family member with confidence, ensuring a smooth transition and preserving family harmony while maximizing value for both parties involved.

1. Establish Clear Communication:

Open and transparent communication is essential when selling a business to a family member.

The business coach may advise the owner to have candid discussions with the family member about their intentions, expectations, and the terms of the sale.

This includes addressing potential conflicts of interest and ensuring alignment on goals and objectives.

2. Conduct a Professional Valuation:

It's crucial to determine the fair market value of the business through a professional valuation process.

The business coach can recommend engaging a qualified appraiser or valuation expert to assess the business's worth objectively.

This ensures that both parties have a realistic understanding of the business's value and can negotiate terms accordingly.

3. Document the Sale Agreement:

To formalize the sale and protect both parties' interests, the business coach may advise the owner to draft a comprehensive sale agreement outlining the terms and conditions of the transaction.

This includes details such as purchase price, payment terms, transition arrangements, and any contingencies or warranties.

Having a legally binding agreement helps mitigate misunderstandings and disputes down the line.

4. Consider Financing Options:

(See Above)

Depending on the family member's financial resources, the business coach may suggest exploring different financing options for the sale.

This could include seller financing, where the owner provides a loan to the buyer, or external financing through banks or other lenders.

The coach can help evaluate the feasibility of each option and structure the financing arrangement to meet both parties' needs.

5. Plan for Succession and Transition:

Selling the business to a family member involves not just a transfer of ownership but also a transition of leadership and management.

As your coach, I will work with you to develop a succession plan that outlines roles and responsibilities, identifies key stakeholders, and ensures continuity of operations during the transition period.

This includes addressing issues such as training and development, integration of new management, and communication with employees and stakeholders.

6. Seek Professional Guidance

Selling a business to a family member can be emotionally charged and complex, requiring careful navigation of family dynamics and business considerations.

As your coach, I will introduce you to and strongly recommend seeking advice from legal, financial, and tax professionals with experience in family business transactions.

These experts can provide valuable guidance on structuring the sale, addressing tax implications, and ensuring compliance with legal requirements.

Business owners wanting to sell their business in this competitive marketplace must increase the value of their business and be taking the following steps to do this now

Training employees

Developing managers

Documenting systems

Increasing sales and profits

Developing long-term customer relationships and recurring revenue

Creating a competitive advantage

Building a business that doesn’t need you to be in it to be successful

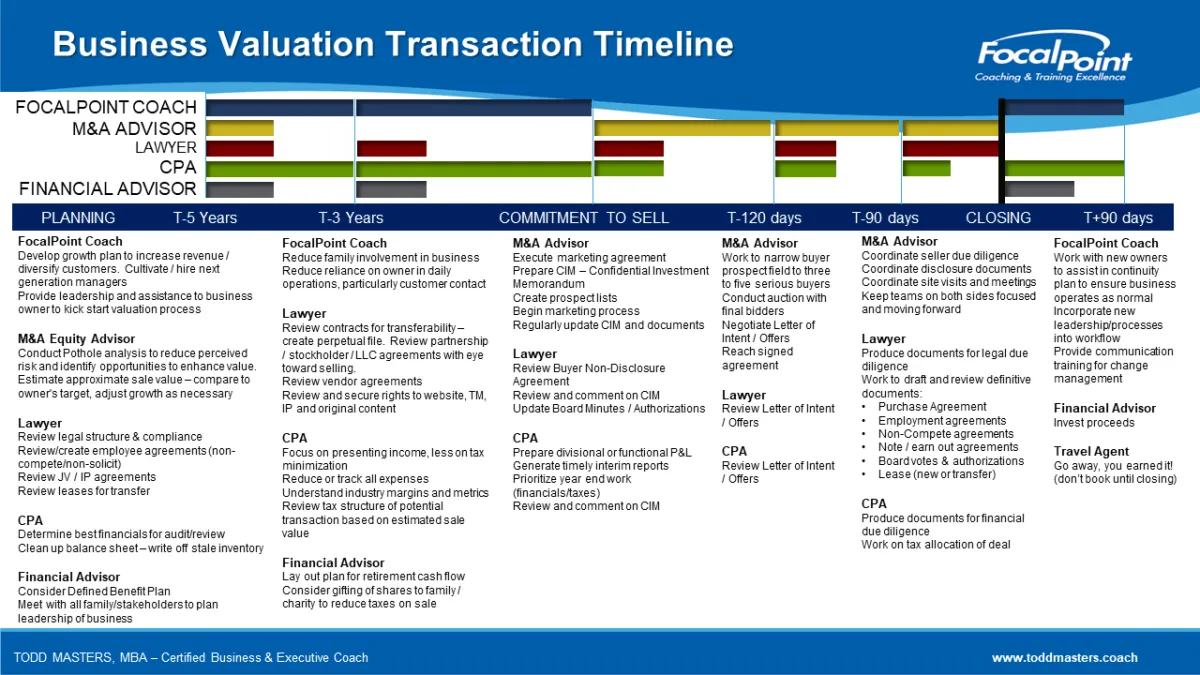

You must START YOUR EXIT PLANNING NOW

This process often takes 3-5 years.

With effective business coaching this can be accelerated and often done in 12 months or less

Build Your Succession/Exit Dream Team

FocalPoint Coach

Your coach will be your team captain to help you find and vet out the best resources for your business and build an action plan to get you full value for your business

M&A Equity Advisor

Your equity advisor or valuator will guide you through a comprehensive analysis to estimate your current value and work with you and your coach to make necessary adjustments to maximize your value

Lawyer

Finding a good lawyer is essential to coordinate all of the agreements, contracts and documents to ensure all the t's are crossed and i's are dotted. This is vital to protect you and your legacy

CPA

Ideally, you already have a CPA you are working with, but you will need to double check their qualifications to help manage through a succession and exit

Financial Advisor

Your financial advisor will help manage the estate plan for your personal gain from the sale of the business. You will need one with experience in the sale/transfer of business assets to personal assets.

If you need recommendations, contact me, I have a Trusted Referral Network with all of the team members you need that I have personally worked with and vetted.

Quick Valuation Assessment

Answer 17 questions/value drivers to quickly estimate your Capitalization Rate to let you know how ready you are to exit your business.

Business coaching will help you define your goals and implement the plan and steps needed to successfully do this!